The media is often recognised as the fourth branch of government sitting next to the executive, legislative, and judicial branches. Recognising its importance in 1787, United States Founding Father Thomas Jefferson said, “were it left to me to decide whether we should have a government without newspapers or newspapers without a government, I should not hesitate a moment to prefer the latter.”

If fulfilling the role of the 4th branch was the goal, then Iceland’s two most widely read newspapers, Fréttablaðið and Morgunblaðið, by and large failed to fulfil their duties before the crash. On the contrary, the papers often served as a mouthpiece of the government and financial institutions, through which they spewed positive propaganda to the public. Although, for example, Morgunblaðið’s editor at the time, Styrmir Gunnarsson, claims the paper, “adequately evaluated external news and information [before the crash],” an examination of what the newspapers had in their hands in terms of external warnings and what they then passed on to the public reveals a serious lapse in journalism.

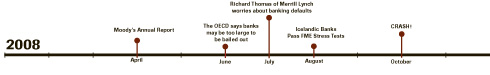

Before the crash, external agencies like Moody’s, the OECD and Merrill Lynch, consistently issued reports warning about the enormity of the commercial banking sector and the absence of a lender of last resort. Each time, the newspapers remarkably minimised their reports and ignored or refuted any critical information about the banks.

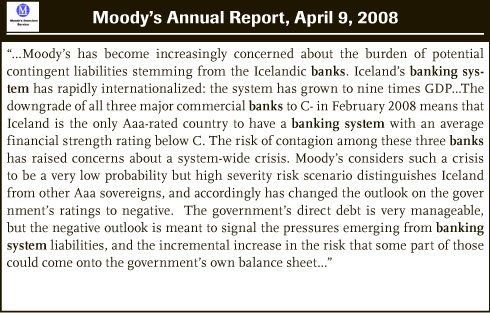

April – Moody’s is worried about Iceland’s banks

On April 9, Moody’s issues its annual report on Iceland, reiterating its

decision to downgrade Iceland’s banks to C- and lower the government’s

rating to negative in February and March, respectively.

On April 9, Morgunblaðið reports, “New Moody’s report says crisis unlikely.” At once the headline sums up a rosy conclusion of a report from an agency that has recently downgraded Iceland’s banks to C- and lowered Iceland’s outlook to negative. The article begins by stating Iceland’s exceptional quality in being the only Aaa ranked country with C- ranked banks, as if this was almost a good thing. It goes on to say, “the state of the banks is said to be concerning, but it’s unlikely that they will be the cause an economic crisis.” Additionally, it reports, “Minister of Finance Árni M. Mathiesen says discussions during the last two to three weeks have been moving in a positive direction. Moody’s is very well acquainted with the country and their positive report should push discussions in that direction.”

Thus, it’s generally a positive report.

Morgunblaðið fails to mention that the banks are nine times Iceland’s GDP, and does not include Moody’s warning: “The banking sector in Iceland represents the most burdensome contingent liability. Moody’s considers the three large commercial banks in Iceland as “too big to fail,” a concept that is not affected by the banks having been fully privatised, meaning that we would expect a very high degree of systemic support by the Icelandic authorities for the banks in the event of a stress situation. Given the scale of the banks’ international operations, however, any systemic threat would prove extremely costly to the government if that eventuality were to materialize.”

Of course if they had included all of this, the Minister of Finance would have appeared incompetent and they couldn’t have written up such an overwhelmingly positive interpretation of the report.

Fréttablaðið says speculations are ridiculous

On the following day, April 10, Fréttablaðið covers Moody’s report in an article called, “Ridiculous speculations.” The article begins by quoting Prime Minister Geir Haarde who dismisses speculations that Iceland could run into insolvency problems and says, on the contrary, “exports are increasing, the trade deficit is decreasing and the state of the banks is strong.” Yes, he said, “the state of the banks is strong.”

Then, selectively paraphrasing from Moody’s report, the article says, “Moody’s believes Iceland will come out better than other countries with the Aaa rating and countries with this rating can easily shake all kinds of economic difficulties.”

Did Fréttablaðið not find Geir Haarde’s statement, “the state of the banks is strong,” preposterous after reading Moody’s report, which clearly expresses concerns about the banks? Perhaps they did not read the report. At least that would explain why they fail to point out that a high severity risk scenario makes Iceland different from other Aaa countries and that Moody’s is “increasingly concerned about the burden of potential contingent liabilities stemming from Icelandic banks…the system has grown to nine times GDP…the risk of contagion among these banks has raised concerns about a system-wide crisis.”

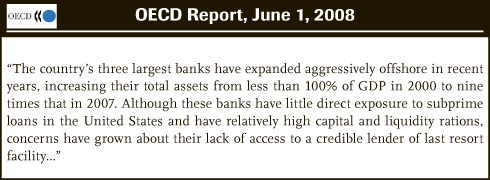

June – The OECD says banks may be too large to be bailed out

On June 6, The Organization for Economic Co-operation and Development(OECD) publishes its Economic Outlook report for all 30 member

countries, specifically pointing out that Iceland’s banks may have grown

too large to be bailed out if that becomes necessary.

Fréttablaðið forgets to mention the OECD’s forecast

Fréttablaðið prints two articles on the OECD report, but fails to communicate any warnings about the banks. In fact, in the first one, “Dark forecast surprises Minister,” Fréttablaðið simply reports what certain people think about the forecast rather than any information contained in the actual forecast.

The article begins by quoting Minister of Business Affairs Björgvin G. Sigurðsson, who says: “The negative forecast is unexpected. It’s possible to make various assumptions, but the current situation does not warrant such a serious forecast…”

The fact is people often scan headlines and read the beginning of articles, which is why the most important information should appear upfront. In this case, the headline and introduction are actually slightly misleading because the article goes on to quote an economist from ASÍ and the director of SA-Confederation of Employers, who are NOT surprised by the forecast. Furthermore, the article concludes with a quote from Director of Samtök Atvinnulífsins (“The Confederation of Employers”) Vilhjálmur Egilsson who says, “there is a lot of uncertainty in all of these forecasts.” In other words, the message is that one shouldn’t put too much weight on the report because forecasts aren’t reliable.

Although these words all came from various experts, the story is constructed in a way that invalidates the forecast. Most importantly, however, the reader has no idea what these men are reacting to, unless they subscribe to OECD reports (unlikely). There is no mention of the OECD’s concerns about the enormity of the banks, the absence of a lender of last resort and its recommendation to increase supervision.

Oops.

Fréttablaðið says bad news doesn’t apply to Iceland

The second article Fréttablaðið prints about the OECD forecast is: “Forecasts worse than last year,” which focuses on the general outlook for OECD countries. In summing up the report, the article states, “Those countries with highly leveraged financial companies will be worse off, Britain is specifically mentioned, but the report states that Iceland should be stable. The United States is also mentioned as the report states, for lowering the average OECD economic growth figures.” Talk about selective reporting.

Fréttablaðið makes absolutely no mention of Iceland’s banks. Instead, the article gives the reader the impression that Iceland is better off than Britain and the United States, despite the fact that Iceland had its own highly leveraged financial companies to be worried about, which the OECD specifically pointed out in their report.

Thus, these two Fréttablaðið articles fail to convey the OECD’s warning of the impending events that took place four months later. Of course the OECD did not predict the crash itself in the report, but the concerning recipe of enormous banks with no possible lender of last resort should have at least been reported.

Morgunblaðið buries the negative forecast

On June 5, Morgunblaðið covers the OECD forecast in “Negative OECD Economic Forecast.” The article appears in the corner of the business page, occupying a space smaller than a deck of cards. It relays the OECD’s recommendation: “In light of uncertainty in the world economy, it would be a good idea to increase reserves of foreign currency and bank auditing.” It also mentions Iceland’s sharp decline in economic growth, a

decline in private consumption and an increase in unemployment.

However, it does not elaborate on the OECD’s specific concern about Iceland’s banks, namely their gargantuan size that precludes sufficient help from Iceland’s reserves in the case of a crisis. Furthermore, when examined in the context of the entire newspaper that day, the negative news is dwarfed by two full-page articles carrying contradictory messages: “No crisis in auditing” and “Have faith in the Icelandic market.”

No crisis in auditing?

In the first article, “No crisis in auditing,” President of Deloitte Ralph Adams, who “has closely followed Icelandic business,” defends the Icelandic economy and the banks. After having recently opened a Deloitte branch in Iceland, Adams states, “…it is important to note that there is neither a financial crisis nor a crisis in auditing” and goes on to explain the current situation in terms of a psychological fear and a crisis in trust whose origins we will wonder about in a few years to come.

In regards to the banks Ralph states: “The British media have been critical of the Icelandic economy lately. Icelanders have called the criticism unfair and sometimes unfounded.” In the banks’ defence, he

says, “They are fishing in the same waters. When a small player does well and grows faster than a big player, the media will naturally talk about it…”

In other words, he discounts the criticism. It’s envy.

Lastly, on financial auditing, which should seemingly be the most remarkable part of the article given the headline, “No crisis in auditing,” Adams expresses the importance of transparency. But, it’s not why you’d think. He says it is a good remedy to the negative reports in the foreign media.

So, in this article, an authority figure who “has closely followed Icelandic business,” addresses and explains away all of the OECD’s concerns. First, he addresses the economic downswing—not a real financial crisis.

Then, he addresses the concerns over the size of the banks— envy of success, and finally, he addresses the need for greater oversight—greater transparency needed to appease the foreign media.

Important looking men believe in the Icelandic market!

The second article, “Have faith in the Icelandic market,” further makes little of the OECD warning which, remember, occupies a space smaller than a deck of cards some pages back. Accompanying the article is a large attention-grabbing photo of three important professional looking men. The caption reads, “Iceland’s friends: Venky Vishwanathan, Jan Olsson, and Hakan Wohlin from Deutsche Bank say Icelandic companies will come out strong from the downswing.”

Without going further into the content, Morgunblaðið’s decision to give this article a full page with a big attentiondrawing photo is in itself a form of editorialising— it shouts: these are important people with important opinions and they believe in the Icelandic economy.

The article begins with these “highlevel” bankers discounting the opinions of people who have been negatively discussing the Icelandic economy and financial ventures because they “don’t understand the situation in Iceland.” The fact that critics don’t understand the Icelandic economy is also restated in the article three times—perhaps for emphasis. Jan Olsson is quoted saying, “Deutsche Bank has great trust in the Icelandic economy and government…The Icelandic banking system has expanded rapidly in the last years but the Icelandic economy is well run.” Jan also explains away the criticism Iceland had been facing, saying, in times of difficulty it’s not surprising that people point fingers, and it’s not surprising that people have been talking about the banks, even if what they say is untrue.

So, after reading Morgunblaðið on June 5, 2008, one is left with the impression that Iceland’s economy and banks are fine, despite the small blurb about the OECD’s forecast. That’s either some seriously good PR from the banks or an especially convenient coincidence.

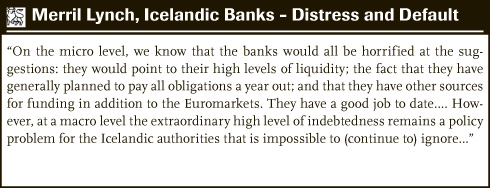

July – Richard Thomas of Merrill Lynch worries about banking defaults

During the majority of June and July, Morgunblaðið and Fréttablaðið ran stories about the króna reaching an all time low as well as the rising inflation figures and predictions from the Central Bank that their target inflation rate would be reached. Yet, there was little discussion in either paper regarding the status of the banks and the absence of a lender of last resort if the banks were to default, until Merrill Lynch published a report on July 24.

Fréttablaðið says the government is ‘surprised’

Covering the report, Fréttablaðið prints a front-page article on July 26, “Intervention necessary,” which continues on page 12, “Wishful thinking and pious words aren’t enough.” The article begins by reporting

that Richard Thomas from Merrill Lynch believes government intervention is necessary in today’s economic situation and questions whether Iceland is not in a similar situation to the US and Britain.

This is of course followed by a quote from Minister of Education Þorgerður Katrín Gunnarsdóttir who says,“Such a comment speaks for itself,” and questions Richard Thomas’ motives.

Furthermore, Fréttablaðið reports that Minister of Business Affairs Björgvin G. Sigurðsson is astonished at Richard Thomas’ criticism, and claims the government and financial sectors work well together (note the irony here! In the Special Investigative Committee’s investigation into Minister negligence, it turns out Björgvin was actually never invited to any financial meetings before the crash. Yet, here he claims the government and financial sectors work well together).

The article continues on page 12, mentioning Richard Thomas’ rule of thumb: “As the CDS of a company trades north of +1,000bps, the market is stating that it expects a default. Both Kaupthing and Glitnir are

currently trading in that area.”

This is good and well, except Fréttablaðið then adds, “Thomas says the actual state of the banks are fine,” rather than “It is time to consider whether or not we will see a default from these banks,” which is what actually came next in Richard Thomas’ report.

Morgunblaðið has no comment

Morgunblaðið did not have much to say about this one.

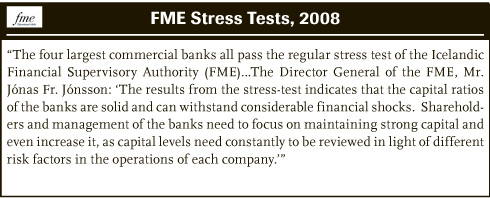

August – Icelandic Banks Pass FME Stress Tests

Despite countless warnings about the bank’s size, the Financial Supervisory Authority (FME) conducted a Stress Test on August 14 to see whether the banks were in a position to take on considerable financial shocks and the banks pass with flying colours.

Morgunblaðið takes their word for it

On August 15, Morgunblaðið reports, “State of the banks is strong and they can withstand significant shock.” The coverage is quite basic and matches the FME’s press release very closely. In fact, the article includes a quote from Icelandic FME director-general, Jónas Jónsson, which was simply lifted from the press release, although not sourced that way: “The results from the stress tests indicate that the capital ratios of the banks are solid and can withstand considerable financial shocks.”

Morgunblaðið does not delve deeper into the issue and fails to ask questions of the FME, such as how the C- ranked banks passed their stress tests despite receiving negative rating after negative rating from external rating agencies. They simply take their word for it.

Fréttablaðið also takes their word for it

Fréttablaðið reports, “Withstand FME Test.” Although Fréttablaðið provides coverage beyond the press release and points out that the tests don’t apply to the smaller banks, it does not question the conclusions of the test. The FME, despite being charged with the supervision of the banks, may have decided that it was to the benefit of the banks to boost trust and it is not difficult to imagine their motivation for positive PR at the time. However, a good watchdog tracing the scent from one negative rating to another would definitely have done some barking here. But, no questions were asked.

Why didn’t the watchdog bark?

Less than two months after Iceland’s three largest banks pass the FME stress tests, in October 2008, the banks defaulted, the stock market crashed and people lost a lot of money (and eventually cars and houses). After looking at the evidence, there’s no question that Morgunblaðið and Fréttablaðið missed some blatant warnings about the banks, their enormous size and the absence of a lender of last resort. But, why?

Morgunblaðið journalist Bjarni Ólafsson, who wrote the June 5 article, “No crisis in auditing,” says he can’t remember how he came to write the story, but says someone from one of Iceland’s banks likely contacted the paper to suggest it. In the SIC Report, Morgunblaðið editor Styrmir Gunnarsson says Glitnir Director of Sales and Marketing, Birna Einarsdóttir, called Morgunblaðið up and said, “You are supposed to stand with us.

You are not supposed to criticise and comment on the banks, you are supposed to stand with us.”

Friðrik Þór Guðmundsson, who is among the authors of the SIC Report’s chapter on the media, says there are probably multiple reasons the media didn’t report the warnings from external agencies like the OECD. For one, he points out that many journalists go on vacation over the summer and thus issues related to the banks and the economy are put on the backburner. However, he thinks perhaps the main reason is that people wanted to believe everything was okay.

That’s no excuse. To borrow words from Davíð Oddsson, of all people, “It’s extremely important that the media fulfils its supervisory role, both attentively and responsibly.” Woof!

Buy subscriptions, t-shirts and more from our shop right here!